- Contact us

- +599-9 461 4545

- info@dcsx.cw

Exploring Blockchain in Capital Markets: Why it Matters

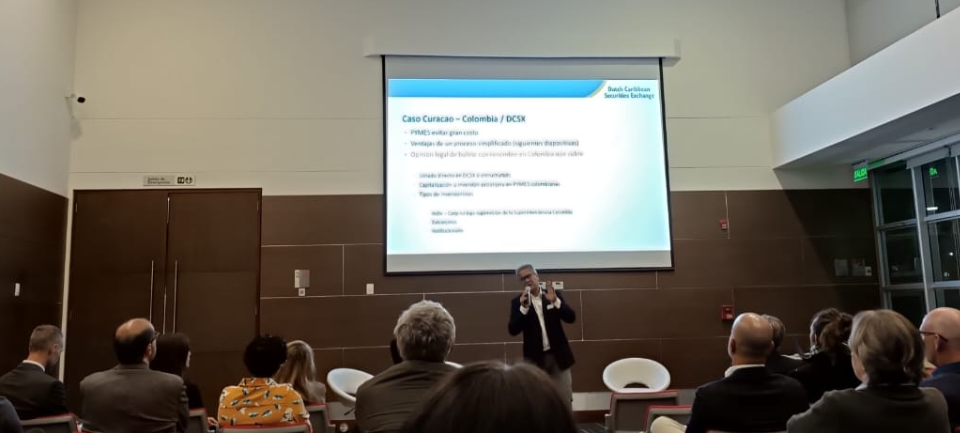

DCSX @ 2021 Annual Private Wealth Latin America & The Caribbean Forum

November 10, 2021

DCSX confirms Okson Energy B.V. as a Listing Advisor

December 14, 2021Exploring Blockchain in Capital Markets: Why it Matters

Publication 8. 2021

Blockchain technology seems to be very attractive to the financial industry. Why?

Blockchain’s ability to process information faster by eliminating intermediaries has the potential to drive down costs while increasing speed which can be applied also to many activities in the financial industry including securities trading and other related services.

In this publication, we will explore at a high level why blockchain is attractive to capital markets. We will touch upon the often called “trilemma” of blockchain, other potential challenges and impacts for the current business models, and the financial (services) market structure. Needless to say, our writing is based on our own research and does not purport to be an expert exposé on blockchain technology in general.

Blockchain in Capital markets

According to the 2016 report published by Euroclear and Oliver Wyman (global management consultants), storing and agreeing datasets of financial obligations and ownership forms the basic core of capital market operations. In their view, the current methods are complex and inefficient with the continual need to reconcile data with massive systems and the often-resulting process duplication. They further mention that the adoption of blockchain technology will ultimately be reliant upon aligning industry standards into a standardization that could improve services and cut costs even using existing market practices and infrastructure.

Blockchain in general offers the opportunity for the business to have transparent real-time data and more efficient settlement of transactions and processing. For the user/customer in the financial industry, it is expected that it will make the financial services infrastructure much less expensive. Euroclear and Wyman (2016) present the perfect scenario for capital markets as follows: “We would have standardized processes and services, shared referenced data, standardized processing capabilities such as reconciliations, near real-time data and improved understanding of counterparty worthiness.”

The level of interest in using the Blockchain or distributed ledger technology (DLT) is high because it brings a massive change to the structure of capital markets which benefits the whole process from pre-trade, trade, post-trade, and subsequent custody and securities servicing. Potential benefits include recording of securities issuance and corporate actions, ownership registry, trading reconciliation, faster clearing and securities settlement, consolidated audit trail, reduction of credit and liquidity risk by requiring pre-funding prior to trading, operational improvements, and data privacy control (JPX Working paper Vol. 15, 2016).

The Trilemma of Blockchain

However, the road to the adoption and implementation of blockchain in capital markets is still filled with several challenges. The first, being the blockchain trilemma, a concept coined initially by no one less than Vitalik Buterin, the founder of Ethereum (ETH). The blockchain trilemma is referred to as the set of issues surrounding the fundamental principles of blockchain technology which are security, decentralization, and last but not least, scalability, that developers encounter when building blockchains:

- Security includes the ability to resist attacks from malicious actors and other factors while ensuring that the data stored on the blockchain is immutable, that it can never be altered according to Ashcroft (2018). In practice, it is the only fundamental part required for the blockchain network to work. Without security, malicious actors can disrupt the network by controlling a major portion of the nodes or by manipulating the ledger’s data. Blockchain technology is open source meaning that it is readily available for everyone to read the code and spend time figuring out how to exploit it. Without security blockchain networks are completely unreliable and useless. Another challenge of security is that it requires a large number of resources. With the Proof Work consensus mechanism, the blockchain needs many participants (miners) to support the network’s security. But as more miners join, the network scalability is affected because of the Proof of Work’s failure to support a high transaction throughput (The Shrimpy Team, 2021).

- Decentralization relates to the fundamental principles upon which Bitcoin and the concept of blockchain -as a whole- was established, providing a trustless environment in which any individual can indiscriminately participate (Ashcroft, 2018) at the same level. In practice, it is the easiest feature to implement in blockchain networks and immediately adds value to the security element. However, if a project wishes to scale the blockchain, the decentralization feature disappears. This is done with permissioned blockchains where only a few users have access. In an environment where everyone is at the same level, the community can still make wrong decisions when there is no moderation. Another issue with decentralization is that it can mostly be achieved through the proof of work protocol which requires a lot of computer power which can negatively impact the electricity supply chain and probably cause environmental problems.

- Scalability pertains to the number of transactions a blockchain can process in a certain amount of time (Ashcroft, 2018). In practice, there are very few blockchain protocols that can support a really large user base at once. Developers often sacrifice security to scale the network. Enterprise Blockchain solutions go as far as to switch to permissioned networks that lack (partly) a full decentralization but enable an extremely high volume of transaction throughput. To feature scalability without damaging security, blockchains would have to switch from proof of work to proof of stake (The Shrimpy Team, 2021).

Solving the “trilemma” would be the ultimate achievement when developing a blockchain and maximizing its potential. However, in many cases, there are situations in which maximizing security, decentralization, and scalability is not the best solution. The adequate balance of security, decentralization, and scalability depends on the conditions and/or requirements of each blockchain project. As time goes by, we constantly see new projects emerge providing an improved version of previous blockchains, and introducing new ideas to address security, decentralization, and scalability including alternative consensus mechanisms such as proof of stake, side chains, state channels, blockchain sharding, increased block size and having multiple blockchains working in conjunction (Im, 2018).

Other Challenges

For capital markets, in particular, the trilemma is not the only challenge on the path to adopting blockchain technology. Regulation is a heavy factor in the financial industry. In other industries, innovators choose to act first and seek forgiveness later. but that doesn’t work in the financial industry where Innovation projects often first require the blessing of regulators.

Industry alignment on common standards and governance will be needed to determine requirements for blockchain (open vs permissioned based), how the blockchains will be managed and improved once they are live. This means a need for updated governance processes including defining which approvals are required, which roles and responsibilities are required to manage the process. Another challenge is managing the operational risks that will arise with the adoption of blockchain including the risk of technical failures. A significant amount of work will be needed to ensure that these operational risks are minimized (Euroclear & Oliver Wyman, 2016).

Cryptography which facilitates the anonymity of users on a blockchain also has its challenges in the industry. While anonymity is what makes the blockchain popular -among other things- in the financial industry, the latter will still need to have the Know Your Client (KYC) information somewhere on the network for anti-money laundering and anti-terrorist financing compliance purposes. The challenge here is to figure out how to link cryptographic identities to real-world identities in a secure manner without disclosing the recorded information. The inability to have the proper process may result in future security data breaches.

Actions to Take

Blockchain adoption will disrupt the current structure of capital markets, the new technology will bring fundamental changes to the role of different market participants such as central securities depositories, clearinghouses, exchanges, clearing brokers, custodians, prime brokers, executing brokers, market makers, investors and asset managers, investment bankers, corporate and retail banks, transfer agents, and remittance providers according to McKinsey (2015). It is expected that the adoption will make some processes more efficient and make others obsolete.

It is important for all participants to be informed as they are constantly under pressure to provide better services and have improved operation activities. Blockchain is an opportunity to improve the business value chain by reducing costs in technology and operations but its adaption within the capital markets may take several years. According to McKinsey (2015) capital markets participants should consider the following actions:

- Assess the impact of blockchain adoption on your business ad plan for the long term.

- Work together with other industry participants and regulators to design the right solutions.

- Capture the internal ledger synchronization opportunity (transactions/payments/bookings).

- Compile an accurate picture of specific challenges and operational costs, and isolate the areas where new solutions will be impactful.

- Modernize post-trade activities such as asset/securities booking and transfer.

- Digitize any existing manual processes.

Final Thoughts

The adaption of blockchain or distributed ledger technology in capital markets shows promising expectations, but its development and implementation require cooperation among market participants, regulators, and developers. While it may seem that a large-scale adaption is unlikely to occur in the short term it is expected that there will be an organic growth towards the adaptation of the technology in capital markets. Ultimately, it will depend also on the full blessing of regulators to implement the technology and/or for them to require the same results (operational efficiency and cost reduction) of those not using the technology (yet).

The successful players of the future will be those that prepare themselves for the potential innovative changes and therefore are in a better position to embrace new methods. Almost every major financial institution in the world is currently involved in developing blockchain technology through internal development or joint ventures with other companies. NASDAQ, Visa, Citibank, Capital One, The Bank of England are some of the most famous companies that heavily invested in projects to build distributed ledgers for transactions between financial institutions.

Sources

Ashcroft, S. September 4, 2018. Breaking down the blockchain trilemma to maximize fundamentals. Coin Review. Last accessed November 18, 2021: https://www.coinreview.com/blockchain-trilemma/

Beuhler, K. Lemerle, M, Chiarella, D. Lal, A. Heidegger, H. and Moon, J. December 2015. Beyond the Hype: Blockchains in Capital markets. McKinsey Working papers on Corporate & Investment Banking| No. 12. McKinsey & Company. Last accessed November 22, 2021: https://www.mckinsey.com/industries/financial-services/our-insights/beyond-the-hype-blockchains-in-capital-markets

Coin Market Cap. 2021. What is the Blockchain Trilemma? Last accessed November 10, 2021: https://coinmarketcap.com/alexandria/glossary/blockchian-trilemma/

Gates, M. 2017. Blockchain Ultimate guide to understanding blockchain, bitcoin, cryptocurrencies, smart contracts, and the future of money. ISBN 9781547090686.

Im, DKD. December 10, 2018. The Blockchain Trilemma: The technology trade-offs among security, decentralization and scalability of blockchain. Thesis. University of Pennsylvania. Last accessed November 22, 2021: http://www.davidim.info/docs/blockchain_trilemma.pdf

PwC.2020. Financial Services Technology 2020 and Beyond: Embracing disruption. Last accessed November 22, 2021: https://www.pwc.com/gx/en/financial-services/assets/pdf/technology2020-and-beyond.pdf

Santo, A. Minowa, I. Hosaka, G. Hayakawa, S. Kondo, M. Ichiki, S. Kaneko, Y. August 30, 2016. Applicability of Distributed Ledger Technology to Capital Market Infrastructure. JPX Working paper Vol. 15. Japan Exchange Group. Last accessed November 22, 2021: https://www.jpx.co.jp/english/corporate/research-study/working-paper/b5b4pj000000i468-att/E_JPX_working_paper_No15.pdf

Shrimpy Academy. June 4, 201. What is the Blockchain Trilemma? The Shrimpy Team. Last accessed November 22, 2021: https://academy.shrimpy.io/post/what-is-the-blockchain-trilemma

Trifecta Blockchain Team. October 2019. Trifecta: The Blockchain Trilemma Solved. Last accessed November 22, 2021: https://pramodv.ece.illinois.edu/pubs/Whitepaper2019-9.pdf

University of Hong Kong. 2020. Course Blockchain and FinTech: Basics, Applications, and Limitations: Module 3 Blockchain Platforms and Module 4 Blockchain Applications presented by Professor Siu Ming Yiu. Last visited February 17, 2021: https://www.edx.org/course/blockchain-and-fintech-basics-applications-and-lim

Van de Velde, J. Scott, A, Sartorius, K. Dalton, I. (Euroclear), and Shepherd, B. Allchin, C. Dougherty, M. Ryan, P. Rennick, E. (Oliver Wyman). February 2016. Blockchain in capital markets: The Prize and the Journey. Euroclear and Oliver Wyman. Last accessed November 22, 2021: https://www.oliverwyman.com/content/dam/oliver-wyman/global/en/2016/feb/BlockChain-In-Capital-Markets.pdf

This publication is presented to you by the Dutch Caribbean Securities Exchange.

Written by N. Martina. Edited by D. Intriago and R. Römer.

Download the PDF version of this article: EN